Fed rate hike

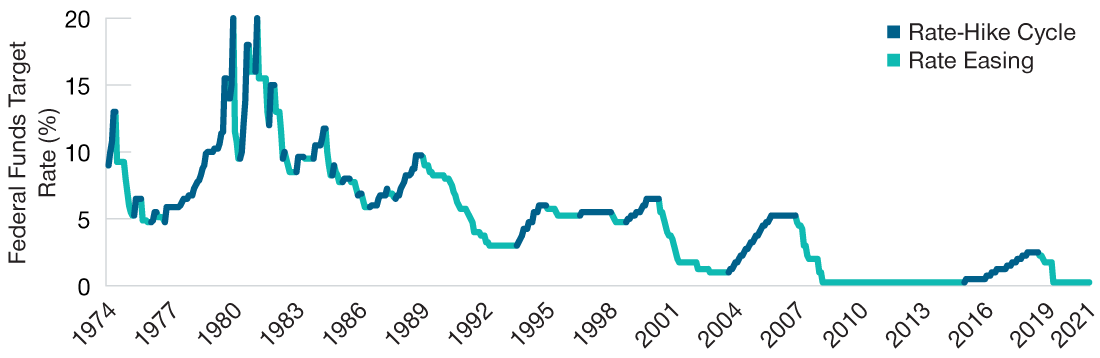

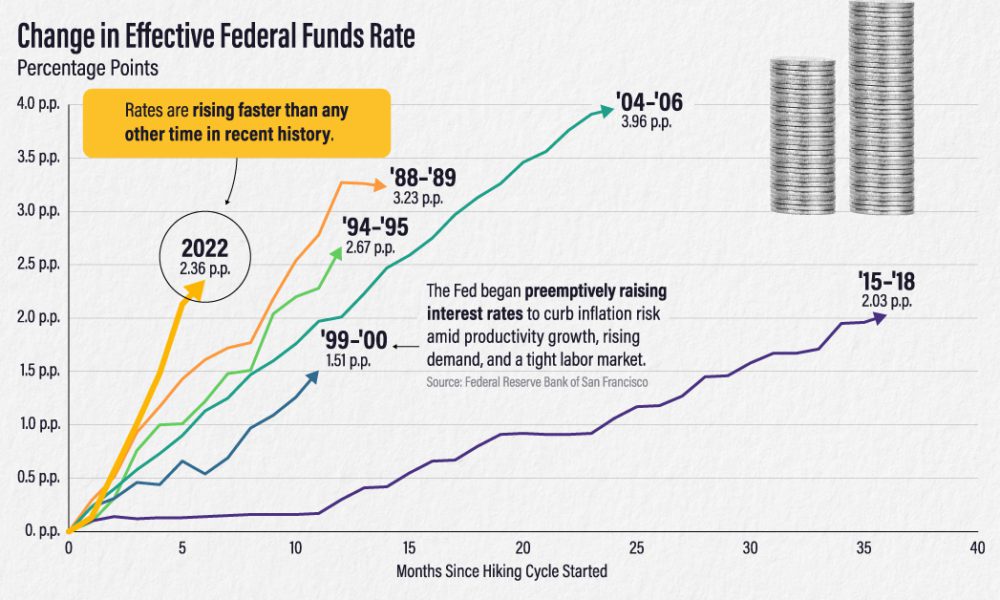

Rate hikes are associated with the peak of the economic cycle. The Fed tried to cool off the economy and the growing real estate bubble by hiking interest rates 17 times in two years raising the fed fund target rate by 4 percentage points over.

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

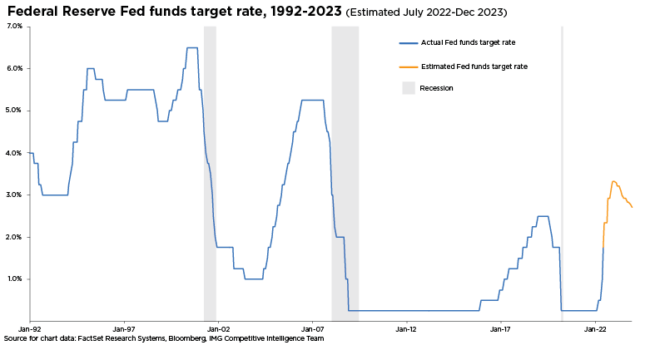

Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

. The Feds five hikes so far in 2022 have increased rates by a combined 3 percentage points or 300 in interest added on every 10000 in debt. How will it affect mortgages credit cards and auto loans. Our Fed rate monitor calculator is based on CME Group 30-Day Fed Fund futures prices which tend to signal the markets expectations.

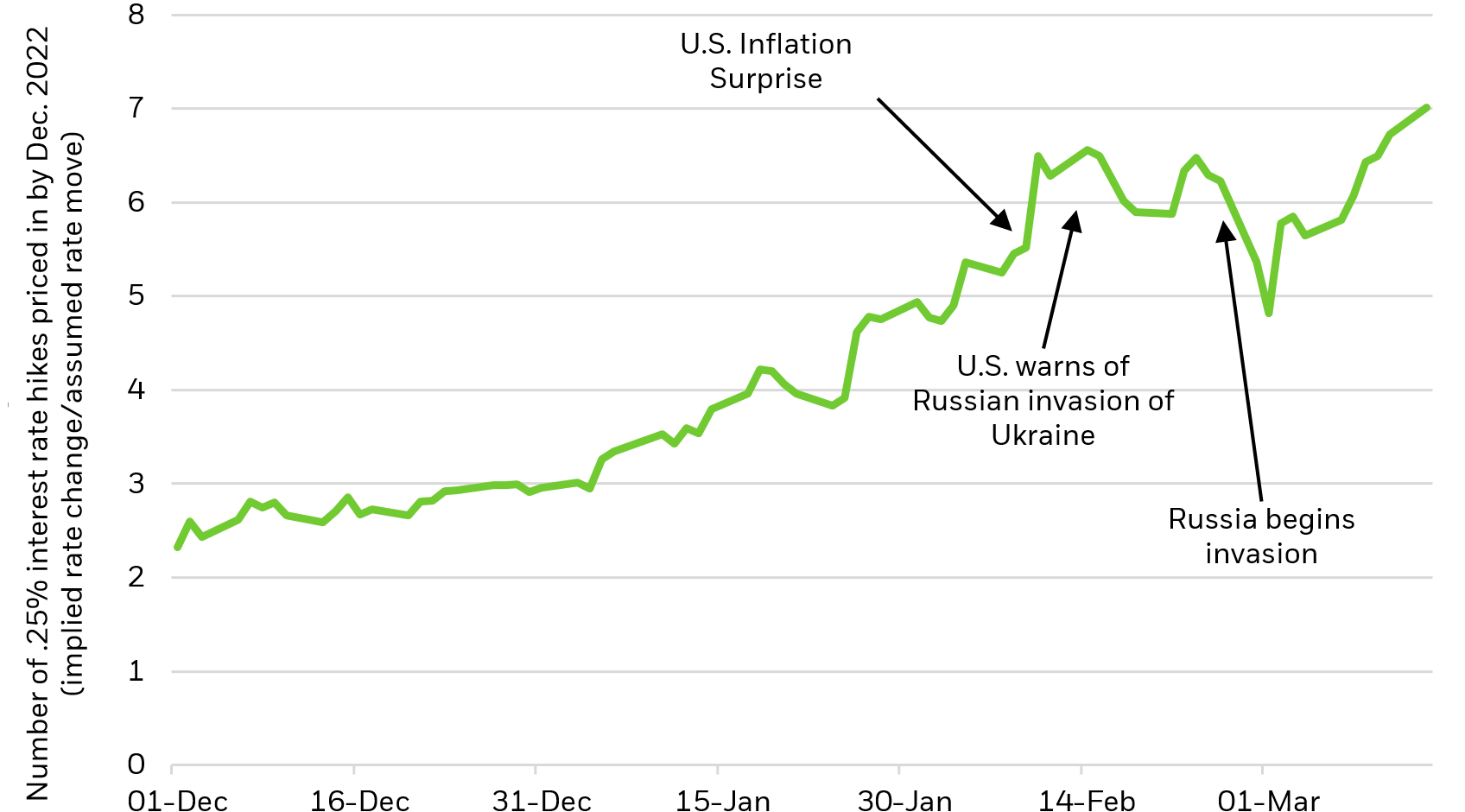

Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov. Prices rose by a hotter-than-expected 83 in August while core inflation a measure that excludes volatile food and energy prices jumped by 63. 7 hours agoThe Federal Reserve opted for yet another 75-basis-point rate hike at Wednesdays FOMC meeting.

1 day agoThe latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate. That implies a quarter-point rate rise next year but.

Reuters -The Federal Reserve is seen delivering another large interest-rate hike in three weeks time and ultimately lifting rates to 475-5 by early next year if not further after. The Fed is expected on November 1-2 to deliver its fourth straight rate hike of 75 basis points and its sixth increase of 2022. During his post-meeting conference Fed Chair Jerome Powell signaled.

The Fed as widely expected raised its key short-term rate by three-quarters of a percentage point. 1 day agoWashington DC. There is growing disagreement among economists about the peak or terminal rate of this hiking cycle.

The Fed has increased rates from near zero in March to a target range of 3 to 325 the highest level since 2008 and the most aggressive pace since the 1980s. The Fed has penciled in a terminal rate in the range of 45475. 1 day agoThe pace of the rate hikes has triggered global anxiety the Fed was dragging the world economy towards a point of no return with the dollars strength against major currencies.

0 Weeks 0 Days 22 Hours 29 Minutes. 1 day agoFed latest rate hike. The bank is moving at a level.

The benchmark rate stood at 3-325 after. 1 day agoPowell announced another interest rate hike on Wednesday. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to.

Adjustable-rate loans such as ARMs that. Fed Chairman Jerome Powell hinted at stepping off the gas in the future but. 1 day agoThe Fed has already hiked rates five times this year the last three at 075 percentage points which used to be considered unusually steep.

The Federal Reserve approved a fourth-straight rate hike of three-quarters of a percentage point on Wednesday as part of its aggressive battle to bring. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates.

Just What Does A Fed Rate Hike Mean Samco Appraisal Management Company

What The Fed Interest Rate Hikes Mean For Home Buyers Owners And Sellers Ramsey

Interest Rate Update Confidence In The Fed But Uncertainty Over Long Term Growth

:max_bytes(150000):strip_icc()/fredgraph-a800d4ef93634168b10b23290a1a57d1.png)

Federal Reserve Interest Rate Hikes In Investors Crosshairs

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IT4N4ITWX5P2VPYL2FZW63IQYE.png)

Analysis Hot Inflation Fuels Case For Big Bang Fed Rate Hike In March Reuters

Fed Swaps Fully Price Three Quarter Point Rate Hike In November Bnn Bloomberg

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Comparing The Speed Of U S Interest Rate Hikes 1988 2022

Us Fed Raises Interest Rates To Fight 40 Year High Inflation World Economic Forum

Maneuvering Through The Fed S Hiking Cycle Ishares Blackrock

Bitcoin Price Hits 20 8k As Volatility Ensues Over Fed 75 Point Rate Hike

Will Steep Interest Rate Hikes Cause A Recession Nationwide Financial

With Inflation Offsides The Fed Keeps Hiking Charles Schwab

Fed Signals No Letup In Inflation Fighting Rate Increases Morningstar

What Would A Fed Interest Rate Hike Mean For Markets Knowledge At Wharton

Federal Reserve Hikes Rates By Half Point To Tame Inflation

Stock Market Outlook 2022 Fed Rate Hikes Wall Street Forecasts

Savers Have Yet To Benefit From This Fed Rate Hike Cycle Marketwatch